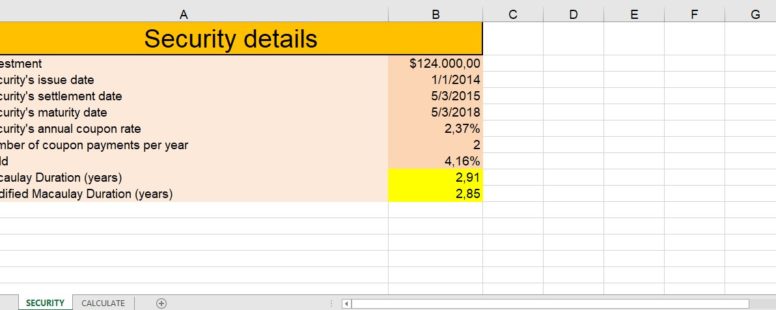

How to use the Financial Functions DURATION, MDURATION

The Macaulay duration (named after Frederick Macaulay) and its modified version, is a measure of a bond’s sensitivity to interest rate changes.

The Macaulay duration (named after Frederick Macaulay) and its modified version, is a measure of a bond’s sensitivity to interest rate changes.

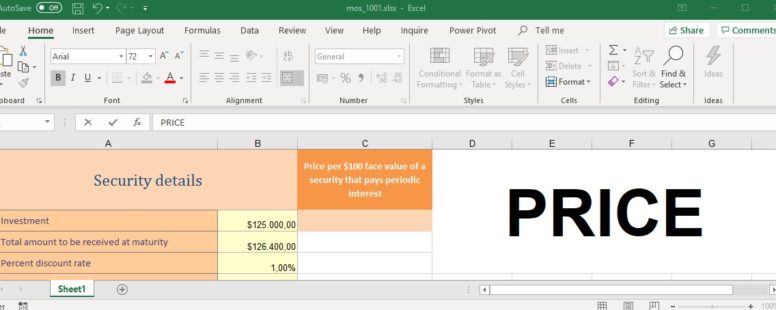

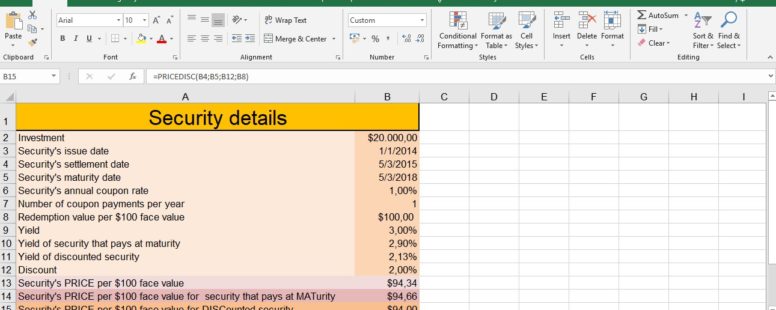

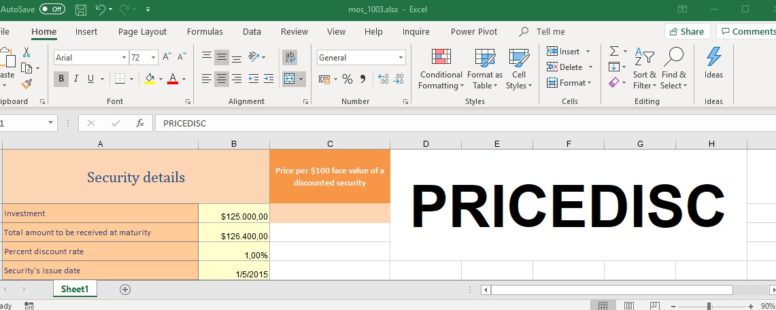

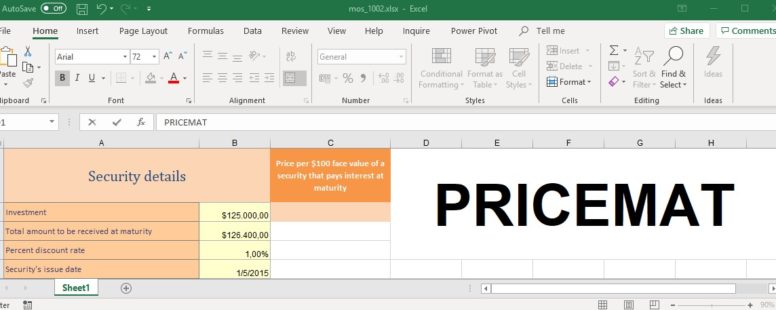

In order to be able to calculate the price per $100 face value we pay for an investment, Excel provides us with 3 tools.

The functions PRICE, PRICEMAT, PRICEDISC.

Excel provides us with numerous functions to calculate and manage securities.

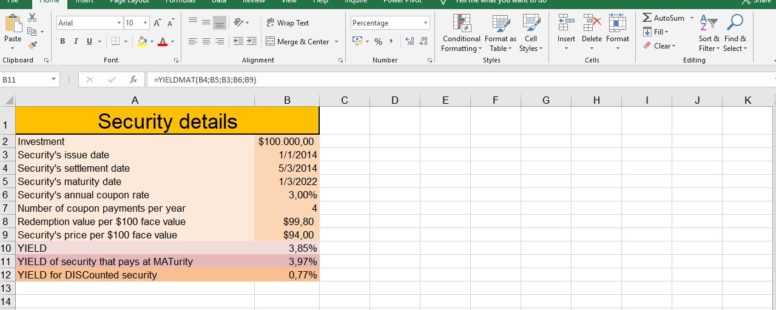

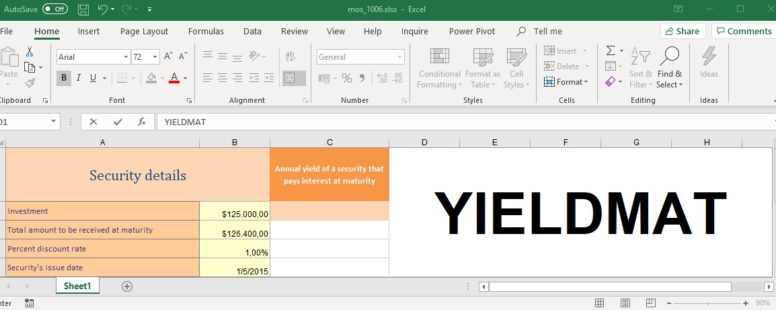

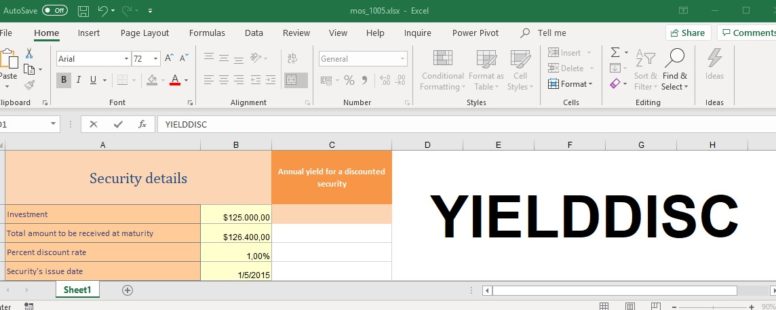

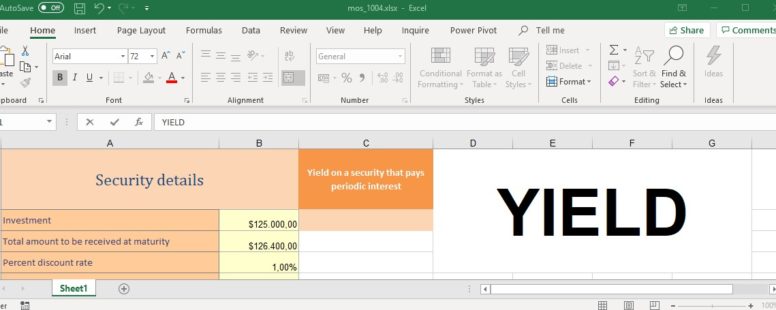

Let’s start with the functions that calculate the Yield of a security. These are YIELD, YIELDMAT and YIELDDISC

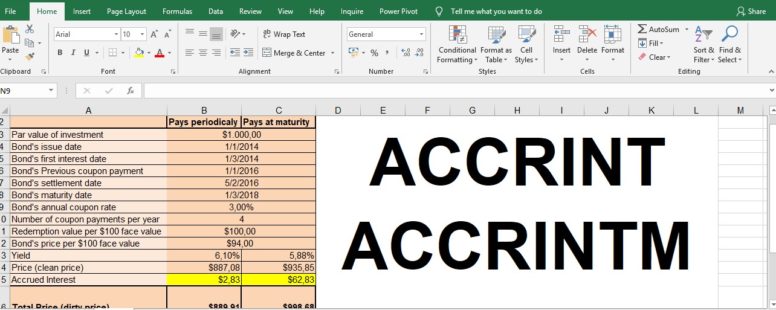

Excel provides us with 2 functions for calculating accrued interest. ACCRINT, ACCRINTM.

But what exactly is accrued interest?

It calculates the annual yield for a discounted security.

It calculates the annual yield for a discounted security.

It calculates the yield on a security that pays periodic interest.

It calculates the price per $100 face value of a discounted security.

It calculates the price per $100 face value of a security that pays interest at maturity.

It calculates the price per $100 face value of a security that pays periodic interest.